Federal Reserve is concerned with U.S. inflation rate.

“Chairman Powell is right; the Fed has to be cautious with the country’s inflation rate. High levels of inflation would harm middle-class Americans the most, which is the reason the Fed should have this under control.”

This week, the Labor Department said that the U.S. consumer-price index had increased by 5.4 percent from June 2020 to June 2021, the highest 12-month rate since August 2018.

This has raised concern among policymakers, especially considering that the so-called core price index (which excludes volatile markets like the energy sector) is at 4.5 percent – with a 0.9 percent increase from May to June, the largest monthly increase since June 2008.

Among these concerned policymakers in Jerome Powell himself, the chairman of the U.S. Federal Reserve, who is sounding a lot less confident about the U.S. economy than earlier this year when he declared that any inflationary pressure to the U.S. economy would be “transitory.”

On Thursday, Mr. Powell told the U.S. Senate Banking Committee that he was “not comfortable” with inflation picking up to levels “well above 2 percent.”

“This is a shock going through the system associated with reopening of the economy, and it has driven inflation well above 2 percent, and of course, we’re not comfortable with that,” Mr. Powell said.

Powell’s comments could suggest that the U.S. Federal Reserve is not happy with the results of its easy monetary policy post-pandemic. If this is indeed true, we could then expect a reversal of this policy agenda.

Part of this concern is fueled by a study released by the own Federal Reserve on Wednesday, which states that businesses have reported price increases well above the expected pace.

This study is the latest “Beige Book report” by the Federal Reserve, which is a report that collects business anecdotes from around the country. The report said that most businesses “expected further increases in input costs and selling prices in the coming months.”

The report also shows a worrisome trend: that because of supply constraints, some goods and services have now considerably higher prices than before the pandemic, price levels that could then become permanent.

By supply constraint, I mean shortages of material and labor, delays in the delivery of inputs, and low inventories, among others. On this specific category, the data shows a 7.3 percent price increase from May to June, the biggest since 2010.

In terms of growth, the Federal Reserve argues that these constraints have resulted in a “moderate” spring growth rate.

However, the Fed also declared that U.S. growth has been better since Late May, as Americans are now spending more on tourism and other services that have been restricted for more than a year.

Similar to Powell’s concerns, U.S. consumer have also expressed their worries regarding the country’s inflation rate. On this subject, the University of Michigan produces a “consumer sentiment index.” The index showed a decline from a score of 85.5 in May to 80.8 in June.

“Rather than job creation, halting and reversing an accelerating inflation rate has now become a top concern,” said Michigan economist Richard Curtin.

“Inflation has put added pressure on living standards, especially on lower and middle income households, and caused postponement of large discretionary purchases, especially among upper income households,” Curtin added.

The consumer sentiment index found a record level of complains related to rising prices on sectors as different as housing and the market for vehicles. On the latter, the U.S. market for used vehicle saw an astonishing price increase of over 10 percent from May to June.

The index also found that people are expecting a 4.8 percent inflation rate for the year ahead, the highest outlook since 2008.

The problem with people already expecting a higher inflation rate for the upcoming year, is that this sentiment is in itself a factor that will lead to a higher inflation rate.

On the people’s fear for inflation, Chairman Powell said, “I know people are very worried about inflation … We hear that loud and clear from everybody … it is really going through the economy and through every business.”

Overall, this is a situation that we at Freedom Today Network talked about on February, when I wrote that the economic stimulus of President Biden was simply too big for the economy to digest. In said article, I argued that:

“If the pandemic had never occurred, the country's economy would be $900 billion larger today. Therefore, a stimulus program that seeks to compensate for this shock should be around a trillion dollars. In contrast, with President Biden's proposal, the stimulus would be three times greater than the external shock produced by the pandemic.”

Ultimately, the problem with all this is that inflation hits the middle class the most. They are the ones who now spend more at the supermarket, when buying clothes to their children, etc. This is why Mr. Powell is right; the Fed has to be cautious with the country’s inflation rate.

By Jorge Jraissati

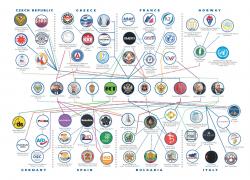

Jorge Jraissati is a Venezuelan economist and freedom advocate. He is the Director of Alumni Programs of Students For Liberty, an NGO advancing the ideas of a free society in over 100 countries. Beyond SFL, Jorge is a research consultant for IESE Business School, an economist from the Wilkes Honors College and the President of Venezuelan Alliance, a policy group specialized in the Venezuelan humanitarian crisis. Jorge is a weekly columnist here at Freedom Today Network.